Economics

Treasury Secretary Battle: Gallatin vs Yellen (and everyone else?)

They sure don’t make Secretaries of the Treasury like they used to. That becomes obvious the moment you compare the views of Albert Gallatin – who served under both Thomas Jefferson and James Madison – vs Janet Yellen – or anyone else in modern...

CBDC: Can States Stop a Central Bank Digital Currency?

The only thing that can actually keep them in check and stop this dystopian nightmare is opposition and resistance. Can states help get the job done? Too early to tell, but the time to push back is right now. Florida, New Hampshire, Missouri, and Texas with ideas and...

This is a Ticking Time Bomb

A massive crisis created by the government, perpetuated by the government. We’re all feeling the pains already today – but the government “solutions” are only guaranteed to make things much worse. Path to Liberty: Feb 22, 2023...

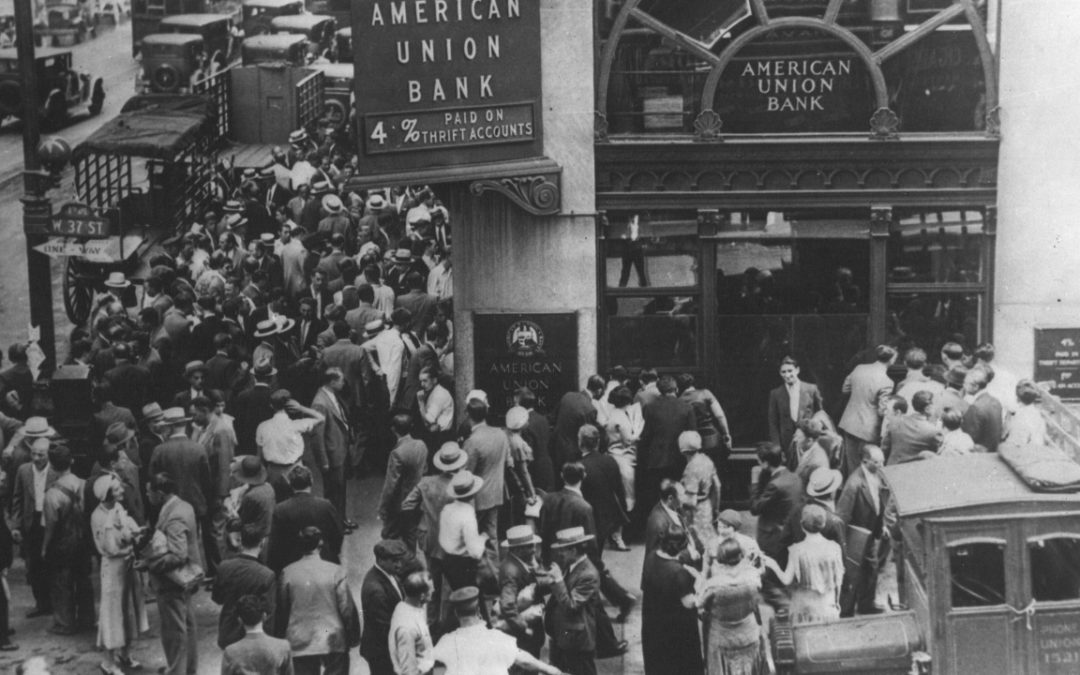

The Bank-Run Phenomenon

One of the most fascinating phenomena in financial crises is that of bank runs. That’s when panicked depositors rush to their bank to withdraw their money because they’re convinced that the bank is going broke. Everyone tries to withdraw his money before that happens....