Tenther Blog

It Wasn’t About Taxes. It Was About Power.

Fear is the Foundation of Government Power

Consolidation: The Liberty Killer

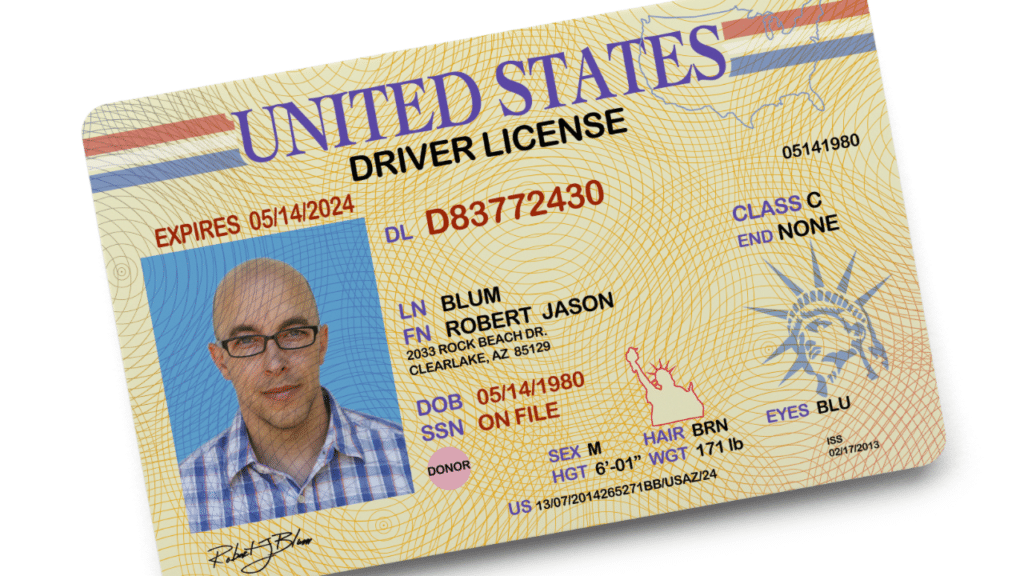

Two Decades Later Feds Still Can’t Fully Enforce REAL ID

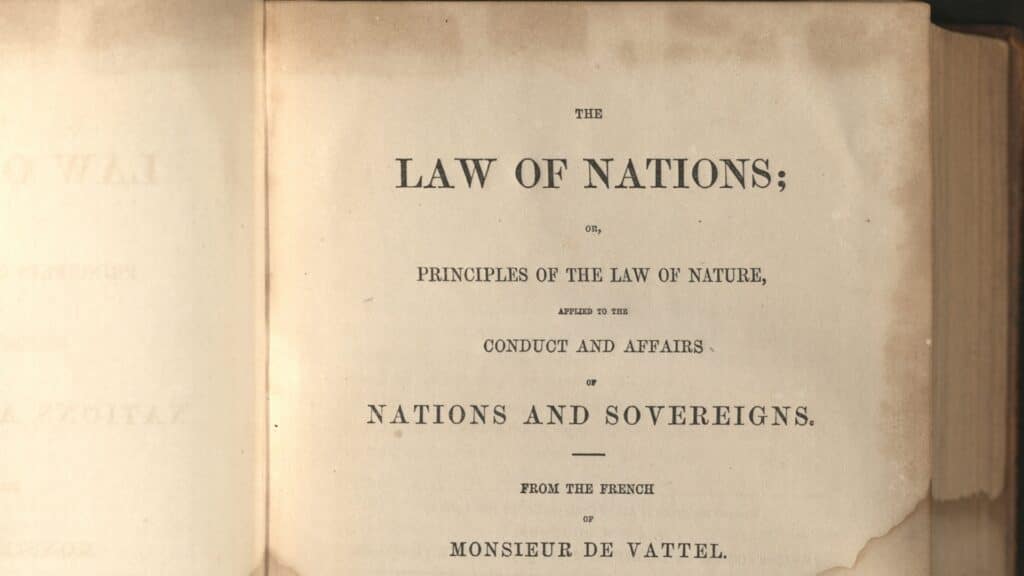

The Founders on how to Handle Suspicious Vessels at Sea

This isn’t a Land of the Free. It’s a Population on its Knees

No Defense? No Rights.

Rights are not a Gift From Government

They Call It Loyalty. It’s Treason.

They Aren’t Patriots. They’re a Trojan Horse.

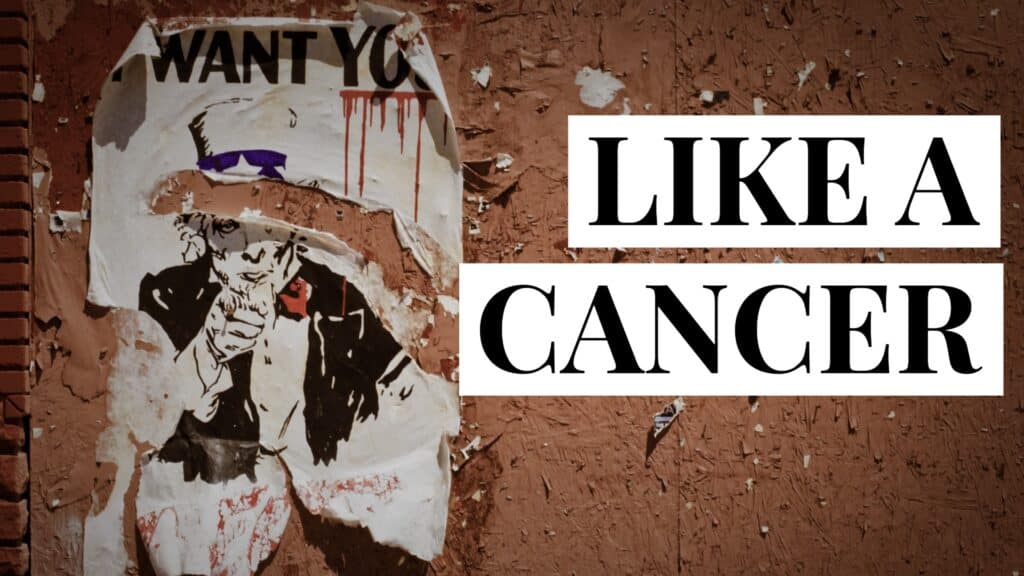

Government power is like a deadly disease

Ignorance Isn’t an Accident. It’s a WEAPON.