Good news! The federal budget deficit for July was only $63 billion, according to the latest Monthly Treasury Statement issued by the Treasury Department.

Of course, this isn’t really good news. Sixty-three billion is a huge number. I say “only” simply because $63 billion pales in comparison to the $864.1 billion deficit in June. In reality, the July deficit continues the trend of unprecedented borrowing and spending we’ve seen throughout the year.

The only reason last month’s deficit gives an illusion of improvement is because the Treasury enjoyed a big influx of revenue with the tax filing deadline shifted from April to July due to the coronavirus pandemic. All of those tax payments that would have normally come in April were shifted forward to last month. The federal government took in $563 billion in July compared to $241 billion in June. That represents a 133.6 percent revenue increase month-to-month.

Looking at the April 2019 Treasury report provides some perspective, as that was the month the Treasury saw its biggest influx of tax payments last year. There was no budget deficit in April 2019. The Treasury Department reported a $160.3 trillion surplus. And going back one more year to April 2018, Uncle Sam enjoyed a 214.3 billion surplus. In fact, tax filing month typically means a budget surplus.

Not this year.

The revenue influx merely obscured the continuation of the federal government’s insane spending binge.

Last month, the government blew through another $626 billion. That’s a 68.7 percent increase over July 2019 – a year that gave us the fifth-largest deficit in U.S. history.

On the year, the Trump administration spent a staggering $5.63 trillion. It has already eclipsed 2019 spending ($4.45 trillion) by over $1 trillion with two months left in the fiscal year.

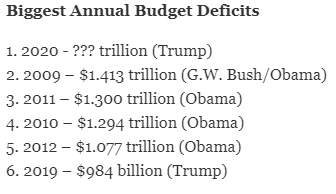

The federal government has spent a record 100 percent more than it has brought in in fiscal 2019 with two months remaining. The yearly budget deficit currently stands at $2.81 trillion. That smashes the previous record shortfall of $1.41 trillion set in 2009 and the year isn’t even over.

It’s easy to blame the ballooning deficits on COVID-19, but the federal government was already spending as if there was a crisis before the pandemic. Through the first two months of fiscal 2020, the deficit was already 12 percent over 2019’s huge number and was on track to eclipse $1 trillion. Prior to this year, the U.S. government had only run deficits over $1 trillion four times, all during the Great Recession. We were approaching those kinds of numbers prior to the pandemic, despite what Trump kept calling “the greatest economy in the history of America.”

Even with the economy supposedly in the midst of a boom, U.S. government borrowing looked more like we were in the midst of a deep recession — before the government-induced coronavirus recession. Long-term US debt sales rose to levels not seen since the height of the financial crisis before the current financial crisis, and the Federal Reserve was already monetizing US debt with quantitative easing before the pandemic.

As of Aug. 13, the national debt stood at $26.6 trillion. The debt to GDP ratio stood at 136.57 percent.

Despite the lack of concern in the mainstream, debt has consequences. Studies have shown that a debt to GDP ratio over 90 percent retards economic growth by about 30 percent. This throws cold water on the Republican mantra “we can grow ourselves out of the debt.”

It’s hard to even fathom this level of debt. And nobody seems concerned. Virtually everybody agrees that trillions in government spending is “necessary” to boost the economy and mitigate the effect of the COVID-19 government shutdowns – Republicans and conservatives included. Everybody is a Keynesian now.

But nobody seems to be asking the most significant question: who is going to pay for all of this? After all, borrowed money has to be paid back.